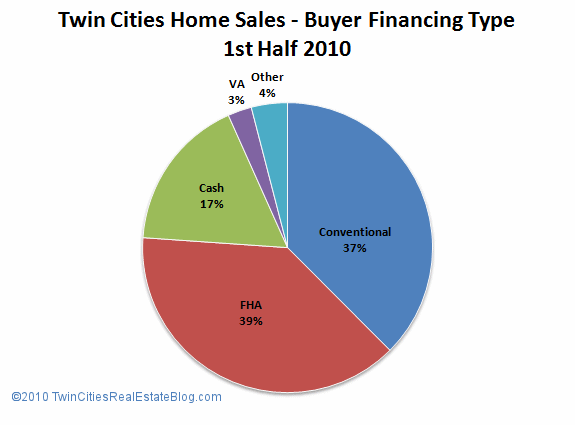

The trend from 2009 continues: nearly 40% of all home buyers in the Twin Cities during the 1st half of 2010 used FHA Loan to finance their purchase. This is up from just 2% in 2007!

Why are so many buyers using FHA loans to purchase their home? Here are some reasons:

- FHA requires only a 3.5% down payment

- FHA 203k (rehab) loans can make it easier for buyers to fix up houses

- FHA underwriting requirements are often now more lenient than Conventional mortgages (below)

- FHA allows higher debt to income ratios and lower credit scores than many Conventional products

- Mortgage insurance is often cheaper than conventional loans

Many consumers believe that FHA loans are only for first-time buyers – that is simply not true. Repeat buyers can qualify too, so long as they are owner-occupants.

I would venture to guess that without FHA loans, 1/2 of those buyers would not have been able to purchase this year – that would have added up to a lot of lost sales!