You have Zillow, Trulia, Case/Shiller, the National Association of REALTORS and the Minneapolis Area Association of REALTORS and many others all release housing statistics that are then mentioned by local media.

The beauty of today is that we have more information than we have ever had before – the problem with today is that a lot of that information is useless or misleading when talking about an individual house, a block or a neighborhood. See, housing isn’t just a local thing… it is a hyper-local thing. I have seen some neighborhoods that have dropped only 10%-20% from the peak pricing and have seen others that have dropped 50% and more – the dynamics involved go beyond what any equation can ever explain.

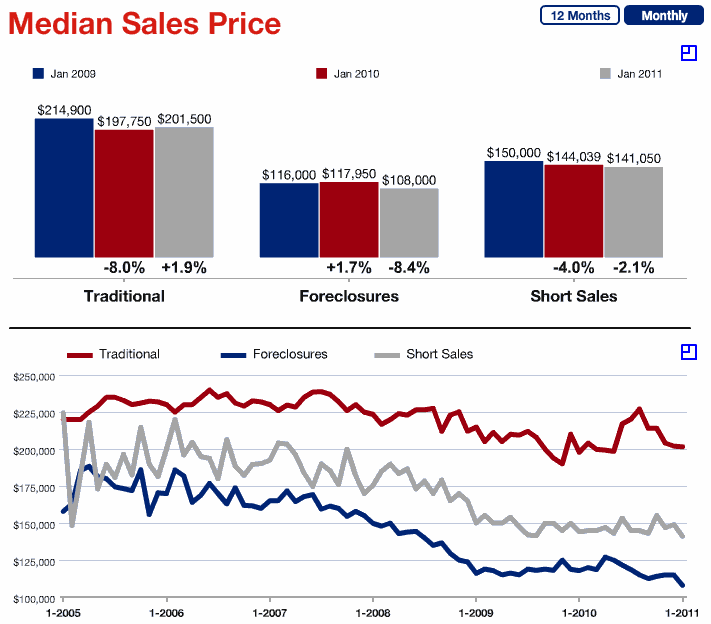

So now that I’ve just told you that metro-wide statistics are poor correlators of micro markets, I’m going to back up and tell you that you should pay attention to one of them….. that’s just the way I roll! Below is a chart of Median Sales Prices split by Traditional Sellers, Foreclosures and Short Sales:

What we see here is that prices in the last 12 months have remained relatively stable in traditional and short sales but that foreclosure prices took a substantial drop – something that surprised me since I had predicted foreclosure prices had bottomed nearly 2 years ago. But up until the last few months my prediction had held quite well!

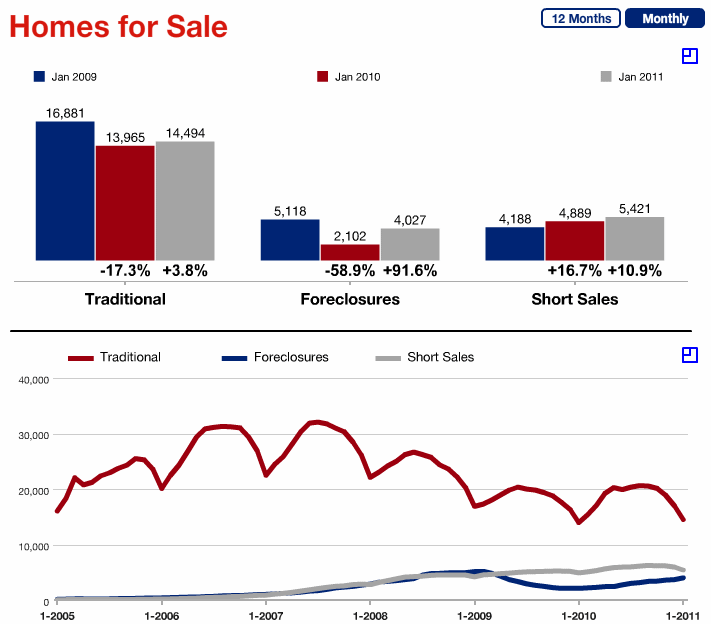

So what has brought about this sudden and recent drop? Foreclosures for sale have nearly doubled from their levels a year ago, which means that supply is clearly outstripping demand and is almost certainly the reason for the price decline:

So back to what I was saying before – while this information is worthless for telling you what your house is worth or what a house on your block is worth, it is a good indicator of one of the dynamics currently in play in our market and that does influence pricing across our market.

[...] However, due to the inordinate amount of foreclosures sold, median sales price was down 10.8%Traditional Seller Prices Rise, Foreclosure Prices Plummet - Aaron Dickinson, Twin Cities Real Estate Blog – This examination of the deeper trends [...]