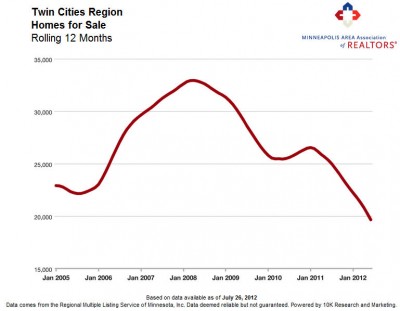

As the number of homes for sale continues to decline in many areas across the country, more and more people are saying the lack of inventory is becoming detrimental to the housing market. I will submit to you that its effect is exactly opposite.

#1 – Higher Offers

While inventory is declining buyer activity is still very strong and thus many houses are now garnering multiple offers. As I’ve said before, the second there is more than one offer on the table, an offer negotiation turns into an auction. In my experience this can buoy the sales price of the home by 3% to 5% and sometimes over 10%! We’re seeing this in the Twin Cities today: since February 2012 sellers have gone from receiving 90.6% of their asking price to 95.1% in June – an increase of 4.5% in just 4 months!

#2 – Fewer Underwater Mortgages

So we have limited supply driving buyers to make stronger offers on houses. This consequently is lifting home sales prices. As home sales prices rise, fewer and fewer homeowners will find themselves underwater. This should dramatically reduce future mortgage walkaways as homeowners will find hope in housing once again.

#3 – Stronger Buyer Confidence

As prices rise, many buyers who have been sitting on the fence worrying prices will fall further or “waiting for the housing market bottom” will realize that the housing market has hit bottom and will gain both confidence and motivation to enter the market. This additional buyer demand will only put more pressure on inventory levels.

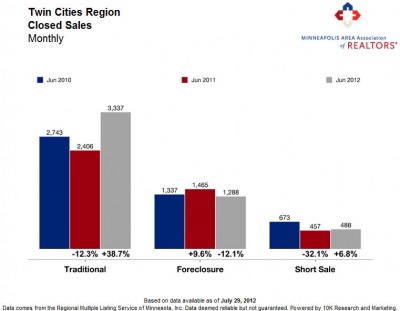

#4 – Fewer Foreclosures and Short Sales Will Actually Buoy Home Sales

As foreclosure and short sale homes for sale fall to 4+ year lows and prices rise, some investors may exit the market. However, the Traditional Buyer is making the switch from distressed properties to Traditional Sellers in droves. When a foreclosure or short sale closes, there is no new home purchased by the seller.

As foreclosure and short sale homes for sale fall to 4+ year lows and prices rise, some investors may exit the market. However, the Traditional Buyer is making the switch from distressed properties to Traditional Sellers in droves. When a foreclosure or short sale closes, there is no new home purchased by the seller.

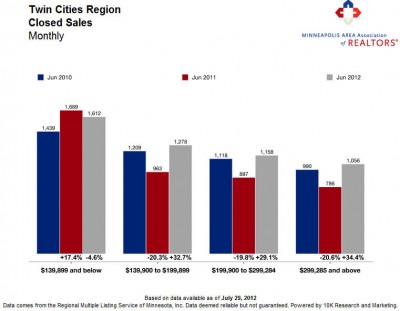

When a Traditional Seller sells, probably 80% or more of them will purchase another home. Consequently that first sale can produce two or even three additional home sales across multiple price points. This trend is very apparent as home sales in the bottom 25% of the market (largely foreclosures and short sales) decrease while the top 75% of homes are seeing dramatic increases in sales.

When a Traditional Seller sells, probably 80% or more of them will purchase another home. Consequently that first sale can produce two or even three additional home sales across multiple price points. This trend is very apparent as home sales in the bottom 25% of the market (largely foreclosures and short sales) decrease while the top 75% of homes are seeing dramatic increases in sales.

#5 – Sellers Will Return to Soften Price Inflation

Sellers are notorious for being the last one to react to the market. Many prospective sellers are still not aware of the changing market dynamics or will only sell once their home value has recovered some. As prices rise and the positive media cycle continues, more prospective sellers can and will bring their home on the market.

Due to the large number of home sellers who have been sitting on the sidelines, a meteoric rise of home prices like we saw from 2000-2006 should not repeat itself as these sellers will act as a pressure relief valve on the housing market as it heats up.

In Closing

The best thing that could happen for the housing market is for us to hit bottom hard and bounce strongly up off of it. A very tight supply of housing with a surge of buyer demand is the perfect way to accomplish that. If we hang around the bottom for the next couple years it will only further dampen housing but if we can show strong improvements in prices, it will kick off a positive feedback cycle that will carry us out of the horror of the last half decade.

Here is NAR’s completely opposite take on things: