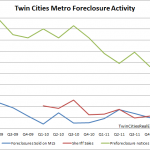

2012 has been surprising in how strong the buyer activity has been and also how much home prices have moved up. Certainly a much stronger year than I was expecting. While every metric used to summarize home prices has its faults, my favorite stat the last 18 months is Average Price Per Square Foot for Traditional Sales: This chart shows why I think is a more accurate view of our housing market tumble: prices were almost consistently falling except for the period during the tax credit expiration in 2010. … [Read more...]