Two months ago I first called the housing bottom in the Twin Cities and I’m back today to repeat that claim and bring new information that has come out in the last two months:

- Pre-foreclosure notices have dropped even further, meaning even fewer foreclosures on the market in 9-12 months

- Sheriff Sales in 2011 declined to the lowest level since 2007

- The number of homes for sale are now at 7+ year lows

- The decline of median sales price from February 2011 to February 2012 was the smallest year over year decline since October 2010

- Further improvements in almost every metric (other than actual median sales price)

Home Sellers are Negotiating Less on Prices

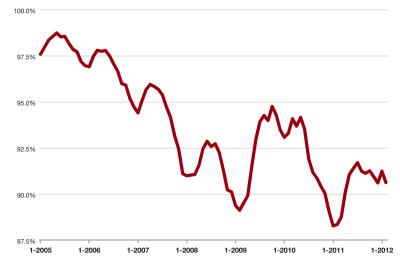

Every winter we see a strong dip in the percent of original list price received at time of sale. This metric takes the final sales price divided by the list price to see how far the average seller had to come down. This winter we had far less of a decline than we do normally (excluding tax credit in 2009/2010) which means that sellers had stronger pricing power than they normally do. For prices to rise, seller’s will need to give up less to sell their homes and my prediction is that the percentage will rise 2%-3% this year.

Supply of Homes at Low Price Points are Declining Rapidly

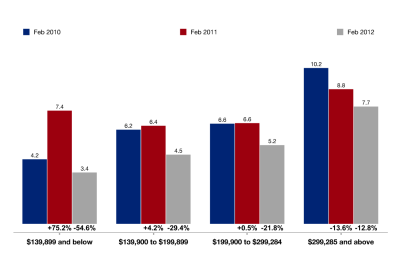

The months supply of homes for sale under $140k is down a whopping 55% from a year ago and the $140k-$200k price range is down a respectable 29% as well. At 3.4 months of supply, homes listed under $140k are in a sellers market, meaning that the supply is low enough to favor sellers in negotiations. Price bottom will be found at the lowest price points first and will support the prices of homes above it so it is great to see this coming to pass.

Multiple Offers Surge

While no stats are available to track actual numbers, about 75% of my transactions this year have involved multiple offers. Agents in my office and throughout my network have been saying the same thing. It used to be that even the well priced and perfect condition homes would sit on the market for a while. Today we’re again seeing them fly off the market in a few days and often with multiple bidders.

Sentiment has Shifted

Buyers again have a fear of loss: many of the homes buyers want are either sold before they get to them or another buyer outbids their offer. This has lead buyers to become far more decisive about the homes they are seeing.

The “Steal of a Deal” Homes are Gone

It got so bad for a while in the last few years that some homes could literally be picked up for peanuts. Today those deals are almost impossible to find. While buyers are disappointed, I am thrilled as it further shows how the market is turning. When buyers can’t steal houses that dramatically lessens the price decline pressure in the market.

I Stand by my Call

In January I stated that home prices were at bottom and with what I have seen and learned in the last two months I am more sure now than I was then. I am now predicting that March of April’s housing numbers will actually show an increase in Median Sales Price versus a year ago, though that should be taken with some caution as the price increase is heavily influenced by the decrease in foreclosure sales and dramatic increase in traditional sales – something I like to call the product mix.

Real home prices may tick up a little bit this year but as prices firm I expect some additional sellers to come into the market and that, coupled with increasing interest rates, will likely keep prices on a slow appreciation cycle.

Agree? Disagree? Please comment!