After years of price declines, today I am here to say that the Twin Cities housing market has bottomed.

Having sold houses for the last nine years I can tell you I’ve seen both the up and the dramatic down of our market… it has been quite the theme park ride! I think we are all sick of the real estate roller coaster and would prefer to enjoy a little “lazy river” type housing market for a while – one that ebbs and flows but without the steep drops or climbs of our recent past.

I’ve spent years looking at many different housing metrics and the last six months have shown a dramatic turn in many fundamentals – far faster than many, including me, expected. While statistics are great, actual experiences of those on the street are still important in “taking the temperature” of the real estate market. As many of the housing statistics were showing improvement, this change was also supported by the experiences I’ve had and the stories I have heard from many other agents in our market.

Today we are seeing a large spike in multiple offers on properties – which is quite surprising since these are normally the slowest months of the year for housing. I have several clients that missed fantastic home value opportunities about a year ago. We’ve been looking and waiting all year for something close to those homes come on the market and expected to see them this winter since this is when the “best bargains” are normally in the market. We’ve been extremely disappointed! If the true bargains are gone, will they be coming back? I’m betting not.

In 12 months I believe that Twin Cities home prices will be effectively flat from where they are today… and may even be slightly up.

These are the key reasons why I believe the housing market has bottomed:

- Total homes for sale are down to levels not seen since 2003-2004

- Buyer demand has increased from its lows without any tax credit incentives

- Available rentals are low, pushing rents higher and more people to purchase

- Foreclosure inventory is at 2007 lows and short sale inventory is at 2008 lows

- Short sale inventory is actually much lower than reported

- Less foreclosures & short sales available = more buyers buying “Traditional”

- Preforeclosure notices are down substantially from their highs

- Sheriff sales are down substantially from their highs

Of course all of this data is regional – in different areas, housing types and price ranges we probably bottomed a year or more ago. In other micro markets we may still see another year or more of housing price declines. When they say real estate is local, what they really should say is that real estate is not only block by block but also type by type and price point by price point. Wondering what’s going on in your micro market? Ask your favorite REALTOR for a more specific conversation.

I welcome thoughtful comments.

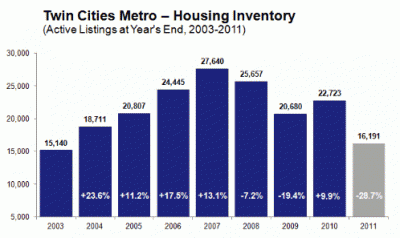

Twin Cities Homes for Sale

The inventory of Twin Cities homes for sale has just hit lows not seen since the 2003-2004 time frame. Inventory at the end of 2011 dropped almost 30% from a year ago and I can tell you that my buyers certainly felt the difference in the number of homes that met their criteria.

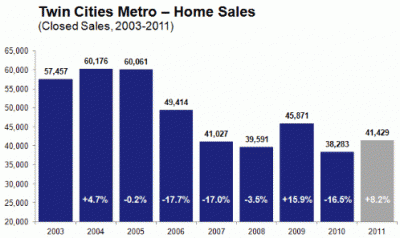

Twin Cities Home Sales

Twin Cities home sales in 2011 were the strongest (for non-tax-credit sales) since 2006. As the economy slowly improves, consumer sentiment is likely to rise and more people will qualify for loans as they get back to work. A more optimistic population and more people working should push sales activity higher in 2012.

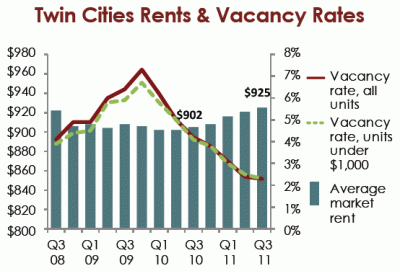

Twin Cities Rentals

The apartment vacancy rate in the Twin Cities has dropped from 7.3% in Q4 2009 to 2.3% in Q3 2011 – its lowest level in 10 years. Average rents have risen from approximately $900 to $925 in that same time period. (source: Marquette Advisors via MHP) As vacancy remains low and rents continue to rise, the rent vs. own equation sways further towards ownership and more renters are likely to enter the home buyer market.

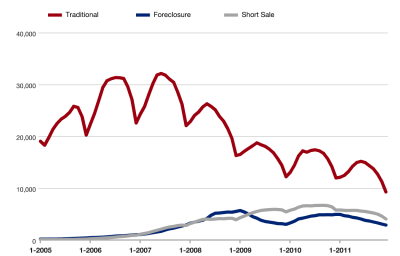

Twin Cities Foreclosure and Short Sale Inventory

Foreclosures and short sales have hit multi-year lows and with such high demand for them, inventory is likely to decline even further in 2012. Less competition=less price negotiation power by buyers. Traditional Seller have hit levels we haven’t seen since the early 2000′s.

Short Sale Inventory Lower than Reported

According to a recent MLS search I conducted, we have approximately 3600 short sales in the Twin Cities that are listed as “Active.” These are the numbers that are tracked and reported in our local market reports. Upon further inspection though, nearly 1800 of these short sales already have an accepted offer and are contingent on approval from the lender. So if we were to report the number of short sales that are truly available for buyers, we’d be at only approximately 1800 units – which is under 5 months of inventory… actually lower than that of Traditional Sellers!

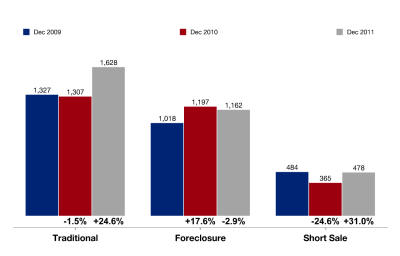

Twin Cities Closed Home Sales by Type

The surge in additional closed sales in December 2011 vs. December 2010 went almost completely towards Traditional Sellers. As foreclosure and short sale inventory continues to decline, buyers will have no other choice but to go back to these traditional sellers. December 2011 proves that these buyers will in fact make that switch.

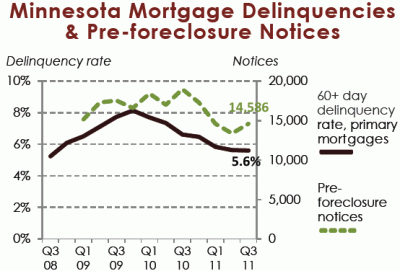

Minnesota Mortgage Delinquencies

Minnesota mortgage delinquencies have dropped from 8% in Q4 2009 to 5.6% in Q3 2011. (source: Mortgage Bankers Association via MHP) Fewer delinquent loans mean fewer preforeclosures. Fewer preforeclosures means fewer foreclosures. Fewer foreclosures mean fewer bank owned homes for sale. The Minneapolis Federal Reserve breaks out where in Minnesota the highest mortgage delinquencies are.

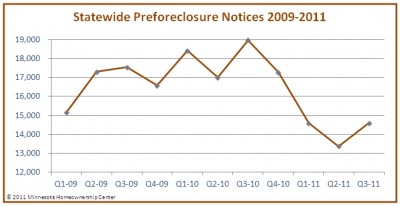

Minnesota Preforeclosure Notices

Not only have mortgage delinquencies fallen in Minnesota, but so too have preforeclosure notices. The Minnesota Homeownership Center’s data shows that while preforeclosure notices did tick up in Q3 2011, they are still down about 20% from their peak a year earlier.

(Quarter 4, 2011 data is now available)

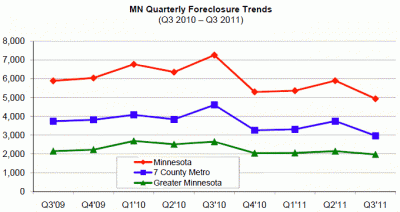

Minnesota Sheriff Sales

Just as mortgage delinquencies and preforeclosures have fallen from their peak in past years, so too have sheriff sales. Sheriff sales were down 32% in Q3 2011 versus the year-ago quarter according to HousingLink’s most recent report. Makes sense – since lenders must first serve homeowners a preforeclosure notice before they can foreclose, if those are down then sheriff sales will naturally be down as well.

Not the End, But the End

If you got this far, congratulations! I could go on and on for hours on this stuff but I believe these are the biggest indicators of our housing market coming into balance. Thanks for reading. I welcome any comments you may have.

[...] Sheriff Sales Are Also Down Dramatically [...]