The housing market has come roaring back in many markets throughout the U.S. and some have been questioning whether the surge of activity we’re seeing has staying power.

In many markets, from 2008 through much of 2012 we saw that nearly half of home sales were of foreclosed or short sale properties. What we’re seeing now is a return back to the Traditional Seller as foreclosure and short sale inventory declines sharply.

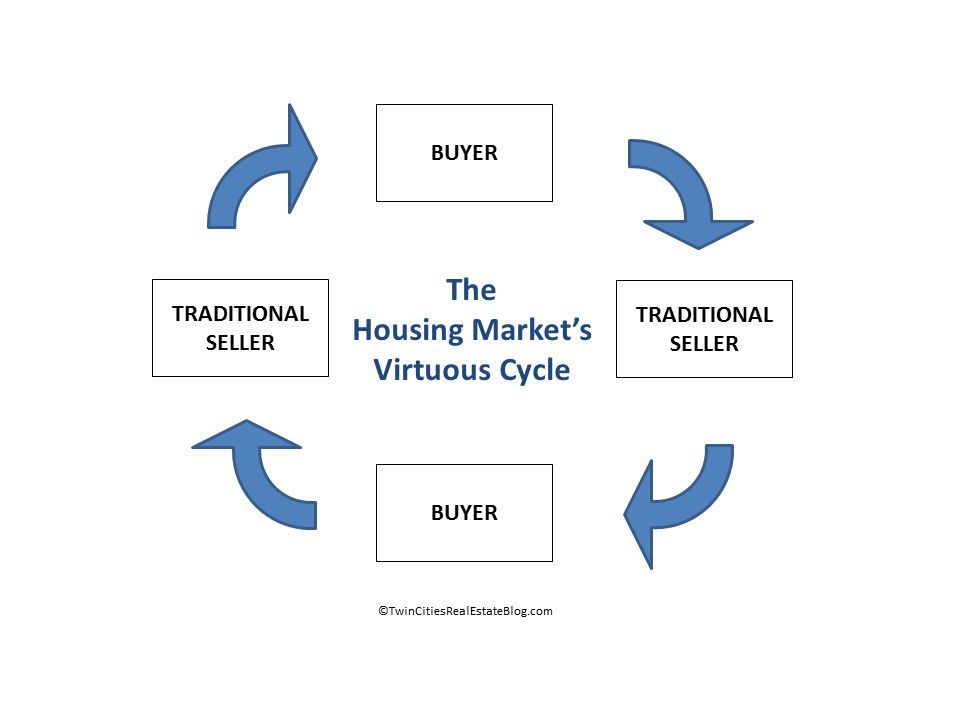

What’s crucial about this return to a more normal market is that in a Traditional Sale, you free up a home owner to buy another property. While not every home seller will buy another property, a good guesstimate would indicate four in five (80%) will buy again. When they purchase, that frees up another seller and the cycle continues:

When a home buyer instead buys a foreclosed or short sale home, the seller of that property is not buying another house and thus the virtuous cycle is broken. I call this the Broken Cycle. When more than half of home sales were these broken cycles, it put a sharp chill on the entire housing market.

While rising home prices and eventual rising interest rates and decreasing investor demand will be a drag on the housing market in the future, the continued decrease in foreclosure and short sale sales will drive more traditional sales and thus free up more buyers to keep the market going.

Home sales will not go up forever and may in fact peak in the next 12-18 months, but as the market gets back to normal we’re unlikely to find a sharp drop off in buyer demand.