For weeks now I’ve been getting the feeling that we’ve turned the corner on prices in foreclosures. Today I’m ready to go out on a limb and take the position that prices on bank owned inventory has bottomed and in fact is likely to bounce up some over the next few months. These are the reasons why I believe we’ve come to this moment:

Inventory is Falling

(image courtesy MAAR)

(image courtesy MAAR)

From February 1, 2009 to April 1, 2009 the inventory of lender mediated (short sale and bank owned) listings has fallen by 1200+ units… a drop of over 13% in just two months. Indications through the first half of April suggest this trend will continue and I’m predicting we’ll be down another 600-700 of these lender-mediated listings once we close out April’s books. While this data includes both bank owned AND short sales, I think the trend is most prevalent in the bank owned homes… see below.

New Listing Activity Appears to be Peaking

(image courtesy MAAR)

(image courtesy MAAR)

Q3 2008, Q4 2008 and Q1 2009 show a peaking of new lender mediated listings coming on the MLS… while no one can say with certainty what will come in the future the fact that this trend has so dramatically broken past trend is a great sign. �Yes the numbers of new listings coming on are still high but the demand is swallowing this new supply faster than it is coming on.

Multiple Offers are the Norm

As recently as January and February it was rare to see multiple offers on many foreclosures but since March 1 the multiple offer has become almost as common as the foreclosures themselves! Homes are being priced much better by the banks than they have been in the past and with the dramatic drop in interest rates since last year and the HUGE financial incentives for buyers we’re really seeing the fire sale I was discussing a few months ago come into play.

Hennepin & Dakota County Sheriff Sales Well off Peak

(image courtesy MAAR)

(image courtesy MAAR)

Everyone is talking about a “2nd wave” of foreclosures coming but we’re not seeing any signs of that yet at the local level. In fact, new Sheriff Sales have been substantially down from their highs for many months. While the www.orary moratoriums of Fannie Mae and Freddie Mac between Thanksgiving and Valentine’s Day and many other lenders in early 2009 holding their foreclosures until the new housing initiatives came out in March have contributed to the lower numbers in recent months the trend down started before the lenders made those adjustments. In March 2009 Hennepin County reported 284 Sheriff Sales and only 169 through April 16, 2009, which means we’re on track for approximately 340 sales this month… 1/2 of our monthly peak back in July 2008! Any future surges in foreclosures should show up in the county data first and will take approximately 6-7 months to show up on the MLS as bank-owned homes.

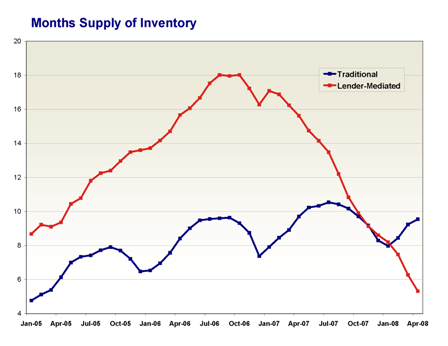

Months of Supply has Dropped Dramatically

(image courtesy MAAR)

(image courtesy MAAR)

The huge increase in demand coupled with the decrease of supply has meant that in the last 12 months we’ve dropped from XX months’ supply to only XX months’ supply. If trends continue as they have, we should see a further drop for April’s figures and into May before potentially flattening out by July as typical seasonal buyer activity starts to wane.

Lender Mediated Sales Prices Have Fallen Steeply

(image courtesy MAAR)

(image courtesy MAAR)

We’ve seen huge price drops on lender-mediated properties in the last 3 years and that price decrease has brought these homes down to a fundamental value that people clearly recognize and has thus brought many home buyers and investors back into the market after years on the sidelines.

[...] on a local level I’m not ready to call a housing market bottom. I do believe however that foreclosures have price-bottomed in our market. Unfortunately I also believe that the typical Traditional Seller has further to fall. Related [...]

[...] Lender Mediated median sales prices are showing a potential bottoming. [...]

[...] While the multiple offer phenomenon is largely focused on the foreclosure market, the fact that multiple offers exist at all in today’s market is a great sign. It says that the market has found price levels and financial conditions favorable enough to draw many bidders for each home. This will help put a floor in house prices in this category and lead to dramatic inventory reductions as these…. [...]

[...] sales prices will remain flat or tick up slightly – foreclosure prices are at their bottom but short sales and traditional sellers will likely drop a little further but higher-priced homes [...]

[...] but that foreclosure prices took a substantial drop – something that surprised me since I had predicted foreclosure prices had bottomed nearly 2 years ago. But up until the last few months my prediction had held quite well!So what has brought about [...]