Here we are, years into the housing crisis, and it seems like while banks have become pretty good at selling foreclosures they are still horrible at closing short sales. On average, short sales a have substantially lower chance of closing than traditional or bank owned listings, which means a huge number of short sales fail and go back to the bank as foreclosures. At the end of the day, short sales sell for far more money than they do as an equivalent foreclosure so each failed short sale means thousands or tens of thousands of dollars more value lost:

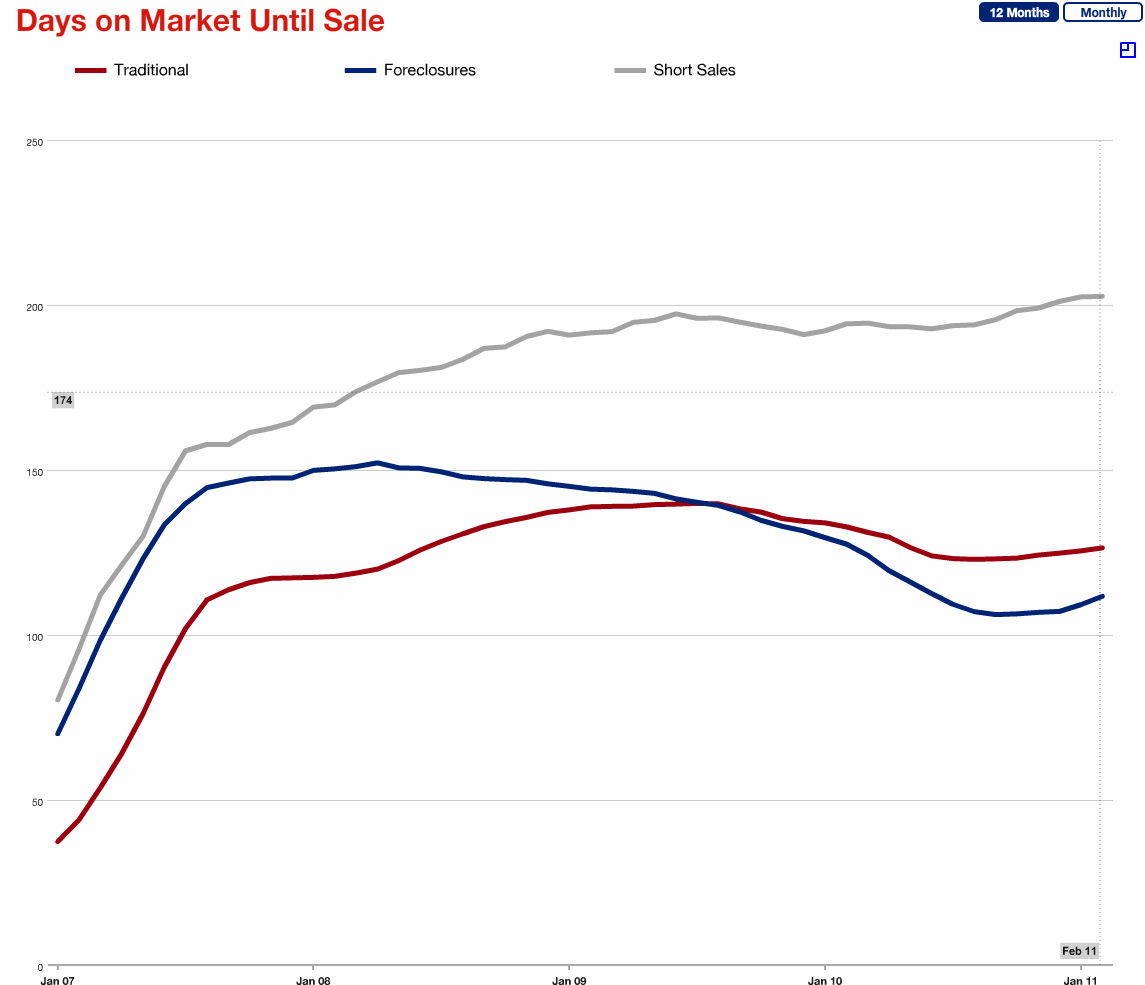

While both Traditional listings and Lender Owned listings have had a decrease in days on market, Short Sales continue to see increases in days on market, which means that the response time from lenders is not improving but likely worsening!!!

If we can get more short sales to close then we will see fewer foreclosures in the future and less pressure on housing prices across the entire market. A successful short sale cuts a good 6-12 months from the housing crisis but only if the lenders, servicers and mortgage insurance companies work together to accomplish this task together.