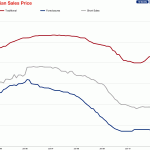

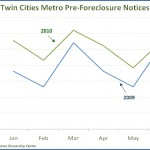

While foreclosures and short sales continue to be around 40% of our sales, when looking at housing prices I believe they should be completely ignored. When looking at all Twin Cities housing sales, here is how the Median Sales Price stacks up: When we split it out to look at Foreclosures, Short Sales and Traditional Sales, we see that Traditional Seller prices have not fallen nearly as much as the composite number suggests: Why we should ignore foreclosure and short sale sales data If we go … [Read more...]