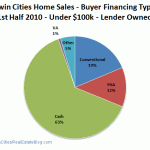

The Twin Cities continues to see spectacular demand from cash home buyers this year and is on track to make 2011 the biggest year ever for cash home purchases. Since the 1st of this year, fully 1 in 4 home sales recorded by the RMLS of MN have been cash sales - 3600+ and counting so far this year! Cash buyers are often investors, but not all of them are. Some investors are buying to turn homes into rentals, which in this market is a growing need, while other investors are buying these homes and then fixing them … [Read more...]